MYOB Payroll — Navigating and Finding

MYOB Payroll — Navigating and Finding

- MYOB payroll and card file command centres,

- payroll categories,

- employee payroll information,

- employee payment transactions,

- employee payroll advice report.

MYOB Payroll – Processing Pays

Once you are familiar with navigating around the payroll command centre module of MYOB you’ll learn how to

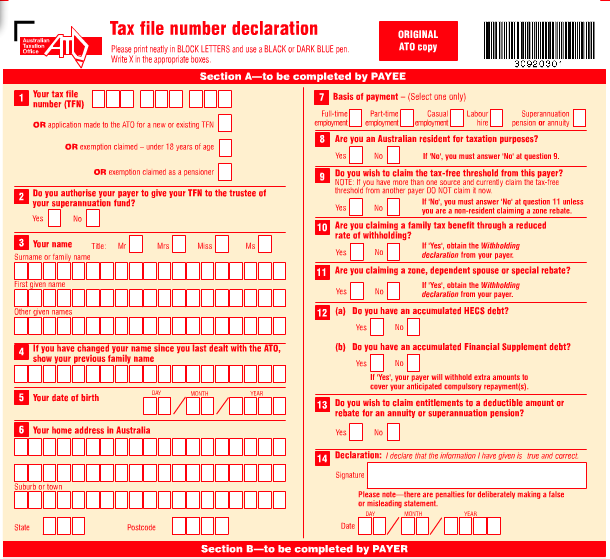

- load the current tax tables,

- create new employee cards and assign wages categories,

- taxes and deductions for them,

- setup the superannuation guarantee for qualifying employees and

- extra super features like salary sacrifice.

Once all the correct data has been entered you’ll

- process the weekly pay,

- look at where transactions are entered in the Accounts list (chart of accounts),

- make modification or deletions if required,

- process the payment of payroll liabilities and superannuation payments and

- deductions like the social club and

- provide employees with their legislated advice slips and payment summaries.

MYOB Payroll – Reporting and Reconciliation

Run several reports including Payroll Summary, employee register, balance sheet and profit and loss to reconcile the entries and payments you’ve made, printing of End of Year summaries for employees and backing up your data and closing the payroll year.

Back to MYOB Training Courses outline Enrol now