Once you have completed your bank reconciliation most of the hard work is done. If you have entered each transaction into the correct account (from the chart of accounts) and it matches your bank statements then all you need to do is extract the data you are looking for.

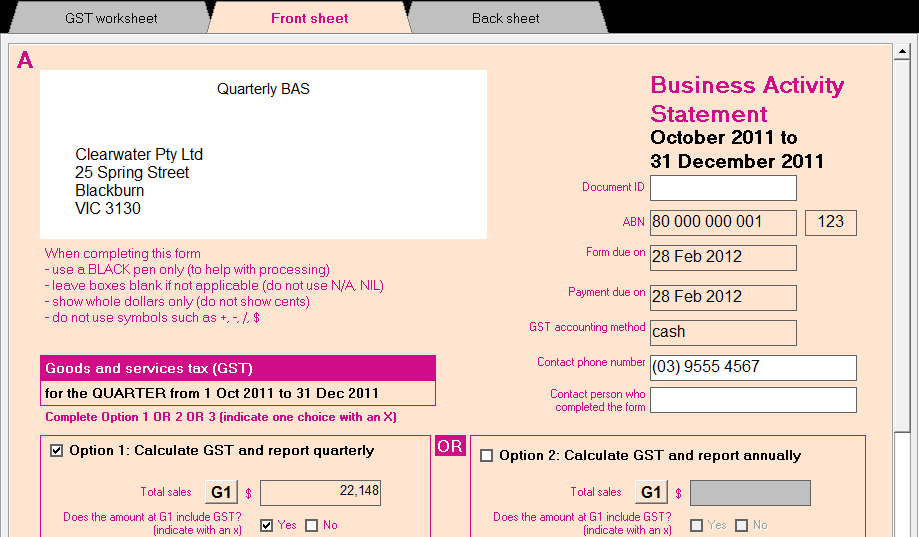

If you have allocated the correct tax codes to each transaction and entry you will find that the GST payable and collected will be automatically reported, all you need to do is then transfer this information to your ATO document (or online via the Business Portal)

MYOB Reporting and BAS

- GST reports,

- How to complete your BAS using MYOB’s BASlink,

- Setup your BAS Info and

- Backup the completed BAS report for that period.

MYOB Financial Reports

Most of the reports you need for your business are standard for the accounting industry and include reports to demonstrate your assets vs liabilities (Balance Sheet), CashFlow and Profit & Loss (income and expenditure).

If your source data is entered correctly, you’ll learn how MYOB takes that data and produces the reports for you. If you need to work with those numbers or produce forecasts you can export to a spreadsheet program like Microsoft Excel to modify as you please.

- Balance Sheet

- Profit and Los

- Cashflow

Back to MYOB Training Courses outline Enrol now